Financial Advisor Automation: Complete Guide for RIAs in 2025

Most financial advisors waste 10-15 hours weekly on manual tasks that could be automated. As a former RIA owner who built Sphynx Automation after transforming my own practice, I've now helped 334 advisors (and counting) reclaim their time through strategic automation.

Why Financial Advisors Choose Automation

- ✅ Eliminate repetitive data entry and administrative busywork

- ✅ Create consistent, professional client experiences

- ✅ Ensure compliance documentation happens automatically

- ✅ Focus on high-value activities that grow your practice

The Hidden Cost of Manual Processes

Based on our assessments with 300+ financial advisors, the biggest time drains are surprisingly consistent across practices of all sizes.

The Administrative Time Traps

📆 Scheduling Struggles: Emailing back and forth to find a time that works for everyone or not being able to easily reschedule if something comes up.

⏰ Data Entry Nightmare: Copying client information from intake forms to your CRM. A single new client requires touching 4-5 different systems, often multiple times.

📋 Client Onboarding Chaos: Sending documents via email, chasing signatures and payments, manually scheduling follow-ups, and hoping nothing falls through the cracks.

⚠️ Compliance Documentation Stress: Manually logging every client interaction, tracking document delivery, and maintaining proper records for regulatory review.

The Real Impact: Even saving just 10 hours weekly at typical advisory rates represents $150,000+ in annual opportunity cost. According to Kitces, advisors who delegate are 80% more profitable than those who don't. Why not delegate to your tech?

How Automation Transforms Your RIA Operations

The difference between manual and automated workflows isn't just efficiency - it's the difference between surviving and thriving as an independent advisor.

Before Automation: The Daily Struggle

- New client calls

- → manually enter notes in CRM

- → schedule follow-up

- → send documents via email

- → wait for responses

- → chase signatures

- → manually update client status

- Time per client: 3-4 hours of administrative work

- Error rate: High (missed follow-ups, lost documents, incomplete records)

- Stress level: Constant worry about dropped balls

After Automation: Streamlined, Efficient Workflow

- New client calls

- → automatic CRM entry

- → triggered follow-up sequence

- → digital document delivery

- → automated signature reminders

- → instant status updates

- Time per client: 30 minutes of administrative work

- Error rate: Near zero (systematic workflows prevent missed steps)

- Stress level: Confident systems handle everything

Real ROI Calculator:

Time Savings: 10 hours weekly × $300 hourly rate = $3000 weekly value

Annual Impact: $150,000+ in recovered opportunity

Client Capacity Increase: Serve 30-40% more clients with same effort

Compliance Confidence: 100% documented interactions, zero missed requirements

The Transformation Timeline:

- Week 1: Immediate relief from repetitive data entry

- Week 2: Client onboarding becomes predictable and professional

- Week 3: Compliance tracking runs automatically

- Week 4: You realize you have time to actually grow your practice

What Our Clients Say: "I went from working 60-hour weeks to 45 hours, while serving 30% more clients. The automation pays for itself." - Sarah K.

The question isn't whether you can afford automation - it's whether you can afford to keep doing everything manually.

Top 10 Automation Workflows for Financial Advisors

After implementing automation for 500+ financial advisors, these workflows deliver the highest ROI and time savings:

1. Calendly → Wealthbox Integration

- What it does: New appointments automatically create contacts and opportunities in your CRM

- Time saved: 15 minutes per meeting

- Why it matters: Never lose a prospect due to manual data entry delays

2. JotForm → Redtail CRM Pipeline

- What it does: Client intake forms instantly populate CRM records and trigger onboarding workflows

- Time saved: 45 minutes per new client

- Why it matters: Professional onboarding starts immediately, no manual data transfer

3. PreciseFP → eMoney Integration

- What it does: Client data gathering flows directly into financial planning software

- Time saved: 2 hours per planning engagement

- Why it matters: Eliminate double data entry between systems

4. Otter AI → CRM Compliance Logging

- What it does: Meeting transcriptions automatically save to client records for compliance

- Time saved: 20 minutes per client meeting

- Why it matters: Perfect regulatory documentation without manual note-taking

5. Email → Task Automation Sequences

- What it does: Client emails trigger automatic follow-up tasks and reminders

- Time saved: 1 hour daily

- Why it matters: Never miss a client follow-up or important deadline

6. Document Signature → Workflow Triggers

- What it does: Signed agreements automatically advance clients to next onboarding phase

- Time saved: 30 minutes per client

- Why it matters: Seamless progression through your service delivery process

7. Calendly → Zoom → CRM Integration

- What it does: Meetings scheduled, conducted, and logged automatically

- Time saved: 10 minutes per meeting

- Why it matters: Complete meeting lifecycle runs without manual intervention

8. CRM → Mailchimp Segmentation

- What it does: CRM tagging automatically updates client categories and triggers segmented campaigns

- Time saved: 2 hours weekly

- Why it matters: Personalized communication at scale

9. Process Street → Client Onboarding

- What it does: Standardized checklists ensure consistent service delivery

- Time saved: 1 hour per new client

- Why it matters: Nothing falls through cracks, professional experience every time

10. Zapier Multi-App Workflows

- What it does: Connect any combination of your existing tools

- Time saved: 5-10 hours weekly

- Why it matters: Your entire tech stack works as one integrated system

Total Weekly Time Savings: 15-20 hours

Annual Value Recovery: $234,000-$312,000

Most Popular Starting Point: 90% of our clients begin with Calendly → CRM integration because it delivers immediate, visible results.

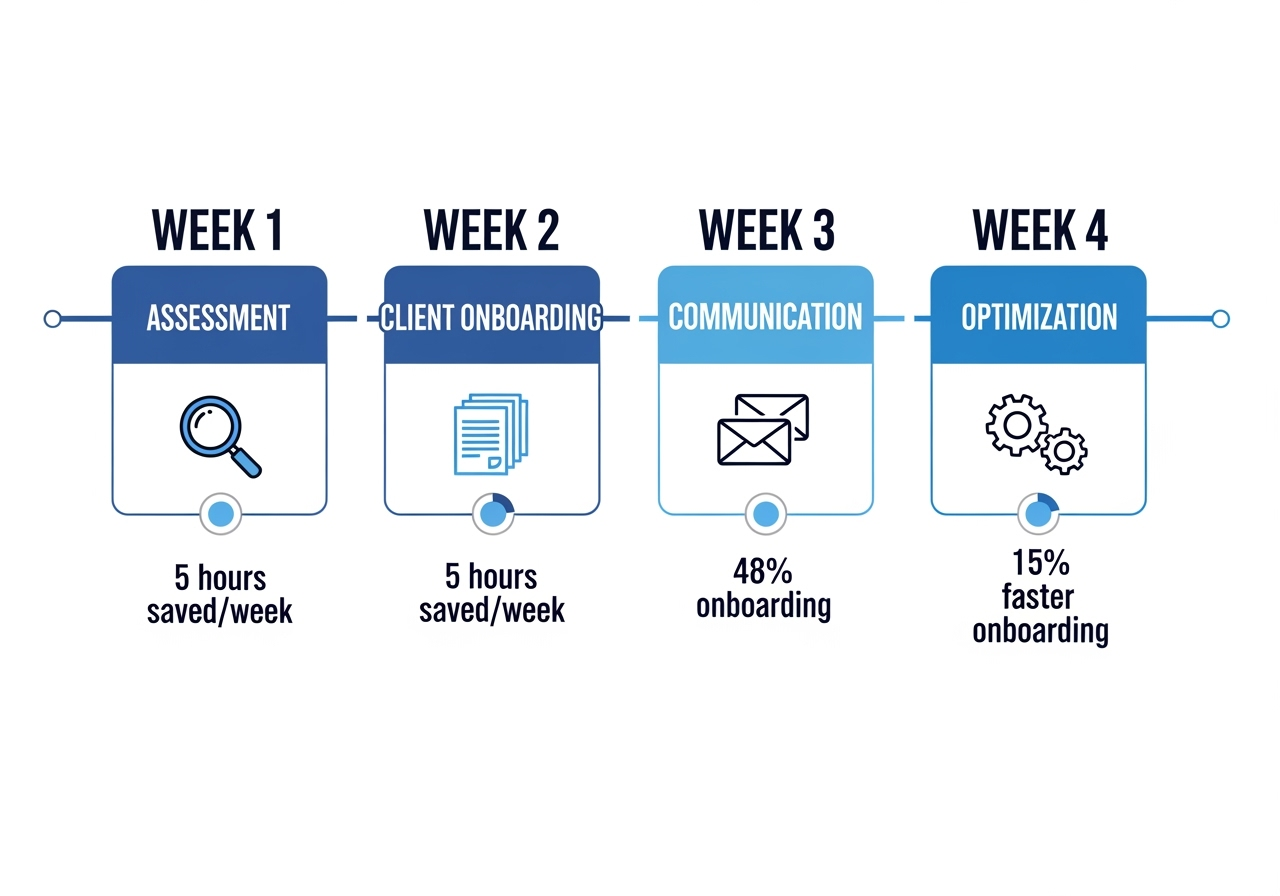

Your 30-Day Automation Implementation Plan

Most advisors try to automate everything at once and get overwhelmed. Here's the proven step-by-step approach that works:

📅 Week 1: Assessment & Foundation

- Day 1-2: Audit your current workflows and identify biggest time drains

- Day 3-4: Choose your first automation (we recommend Calendly → CRM integration)

- Day 5-7: Set up basic integration and test with sample data

Expected Result: 2-3 hours weekly time savings immediately

📅 Week 2: Client Onboarding Automation

- Day 8-10: Implement intake form → CRM workflow (JotForm or PreciseFP)

- Day 11-12: Create automated document delivery sequences

- Day 13-14: Test complete onboarding flow with existing client

Expected Result: Professional, consistent onboarding experience

📅 Week 3: Communication & Follow-up Systems

- Day 15-17: Set up email automation sequences for different client types

- Day 18-19: Implement meeting reminder and follow-up workflows

- Day 20-21: Connect compliance logging (Otter AI → CRM)

Expected Result: Zero missed follow-ups, complete compliance documentation

📅 Week 4: Optimization & Scaling

- Day 22-24: Review and refine all workflows based on real usage

- Day 25-26: Add advanced triggers and conditional logic

- Day 27-30: Train team members on new automated processes

Expected Result: 15+ hours weekly time savings, scalable systems

Common Implementation Mistakes to Avoid:

- ❌ Trying to automate everything simultaneously

- ❌ Not testing workflows before going live

- ❌ Forgetting to update team on new processes

- ❌ Choosing complex workflows before mastering simple ones

What You'll Need:

- Time Investment: 4-6 hours during implementation week

- Ongoing Maintenance: 30 minutes monthly

- Technical Skills: None - we handle the setup

- Budget: ROI positive within first month

Ready to Get Started?

Get Your Free Automation Audit

We'll analyze your current workflows and identify your top 3 automation opportunities. In this 30-minute consultation, you'll discover:

✅ Which manual tasks are costing you the most time and money

✅ The exact automation sequence that fits your practice

✅ Timeline and investment for your specific situation

✅ Quick wins you can implement immediately

No obligation. No sales pressure. Just actionable insights from someone who's been in your shoes.