Announcing: Our Automated Custodial Paperwork Packet!

Sep 14, 2022

Introduction

Financial advisors - boy do we have the treat for you!

We're happy to introduce our new Automated Custodial Paperwork Packet! This is sure to save both you and your clients time when it comes to filling out all that dreaded paperwork by drastically reducing the amount of manual data entry needed to complete each form. The packet is still in beta and is currently set up to work with TD Ameritrade and Schwab paperwork, but we're continuously making improvements and adding more custodians (Fidelity, SSG, and BNY are on the way!) based on the valuable feedback of the clients who have purchased the bundle.

Filling out account paperwork is as tedious as it gets, but unfortunately, it's something that needs to get done. And that's exactly why we've created this automated packet. At its core, the process is very simple: start by filling out a Client Profile Questionnaire with your typical account opening information, then automatically use the information from that submission to pre-populate fitting areas of the custodial paperwork that follows. This eliminates the constant re-entry of information that you've already submitted - three, four, five times, or more - on other related forms. Data submitted via these forms can also be added to your client's contact record in your CRM, if you desire.

Let's take a more in-depth look of the process of filling out a packet.

Where To Start

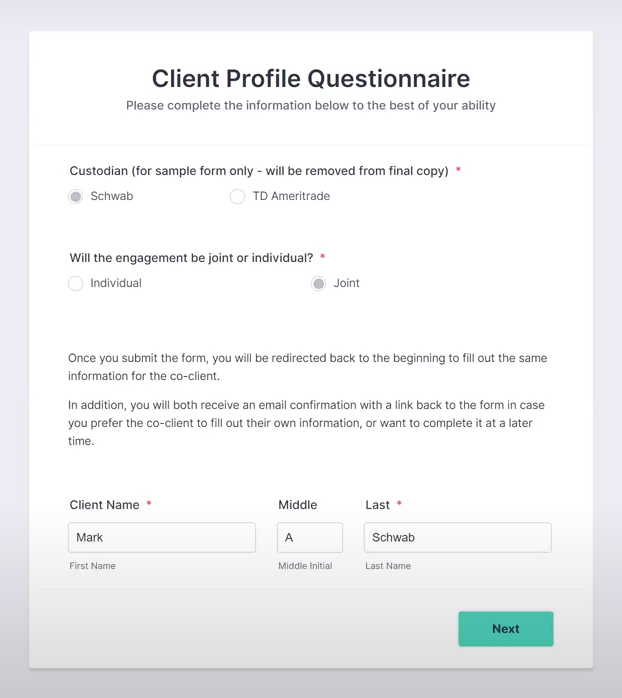

Each process will start the same way, with the advisor sending a Client Profile Questionnaire link to the client they wish to fill out the packet. It'll look something like this:

The client will begin by selecting their custodian and filling out the information that follows. Sections on this form include:

- Personal Information

- Asset / Expense Information

- Income / Employment Information

- Investment Information

- Trust Information

- Children / Dependent Information

- Beneficiary Information

- Authorized Party Information

- Trusted Contact Information

- General Household Information

If the engagement is joint, the user will be redirected back to the beginning of the form to fill out co-client information after the primary client information has been submitted. If the engagement is individual, they will see a "Thank You" page upon submission. After the Client Profile Questionnaire is completed, both the client(s) and the advisor will receive confirmation emails including next steps.

Confirmation Emails & Google Sheet

This section is important, as it will trigger the main automation to run.

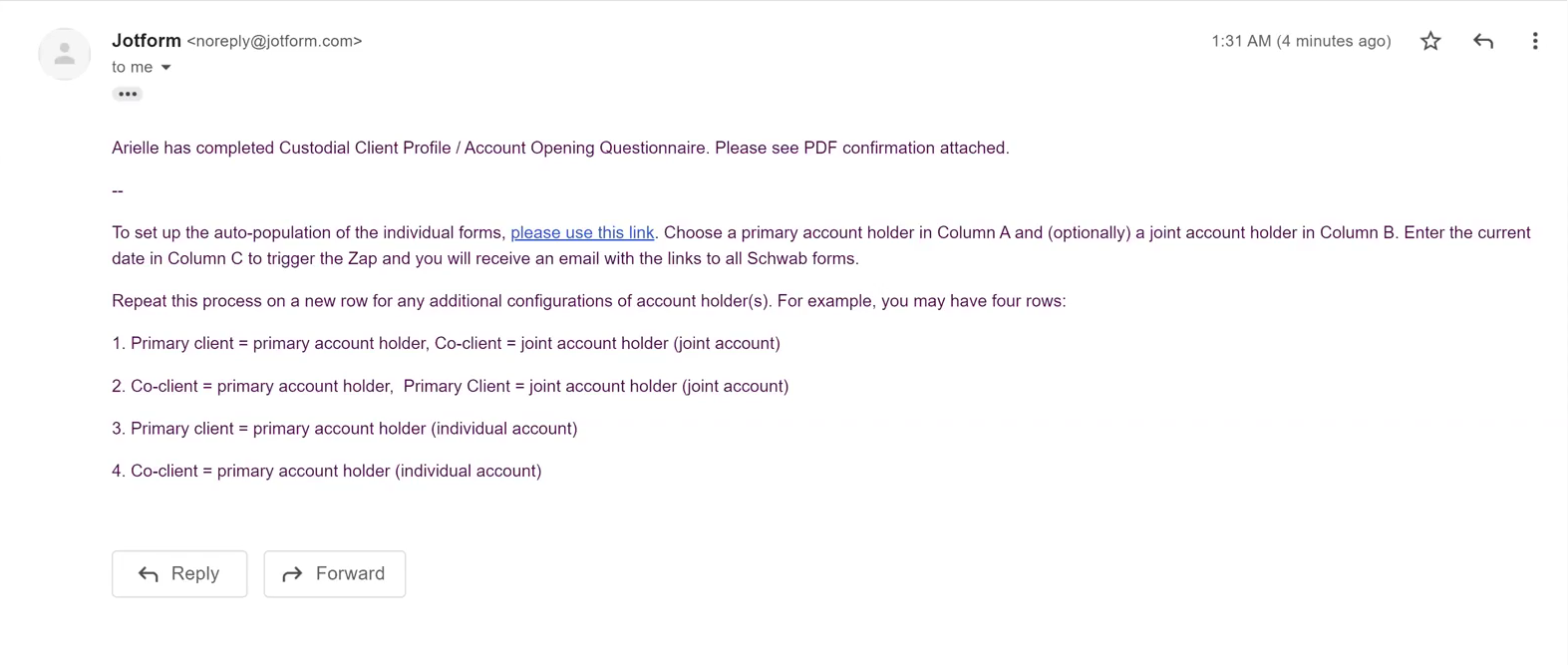

When you (the advisor) receives your confirmation email, it will look like so:

To set up the auto-population of the custodial forms, click the link, which will bring you to a Google Sheet in which you will need to make a couple minor edits. The sheet will look like this:

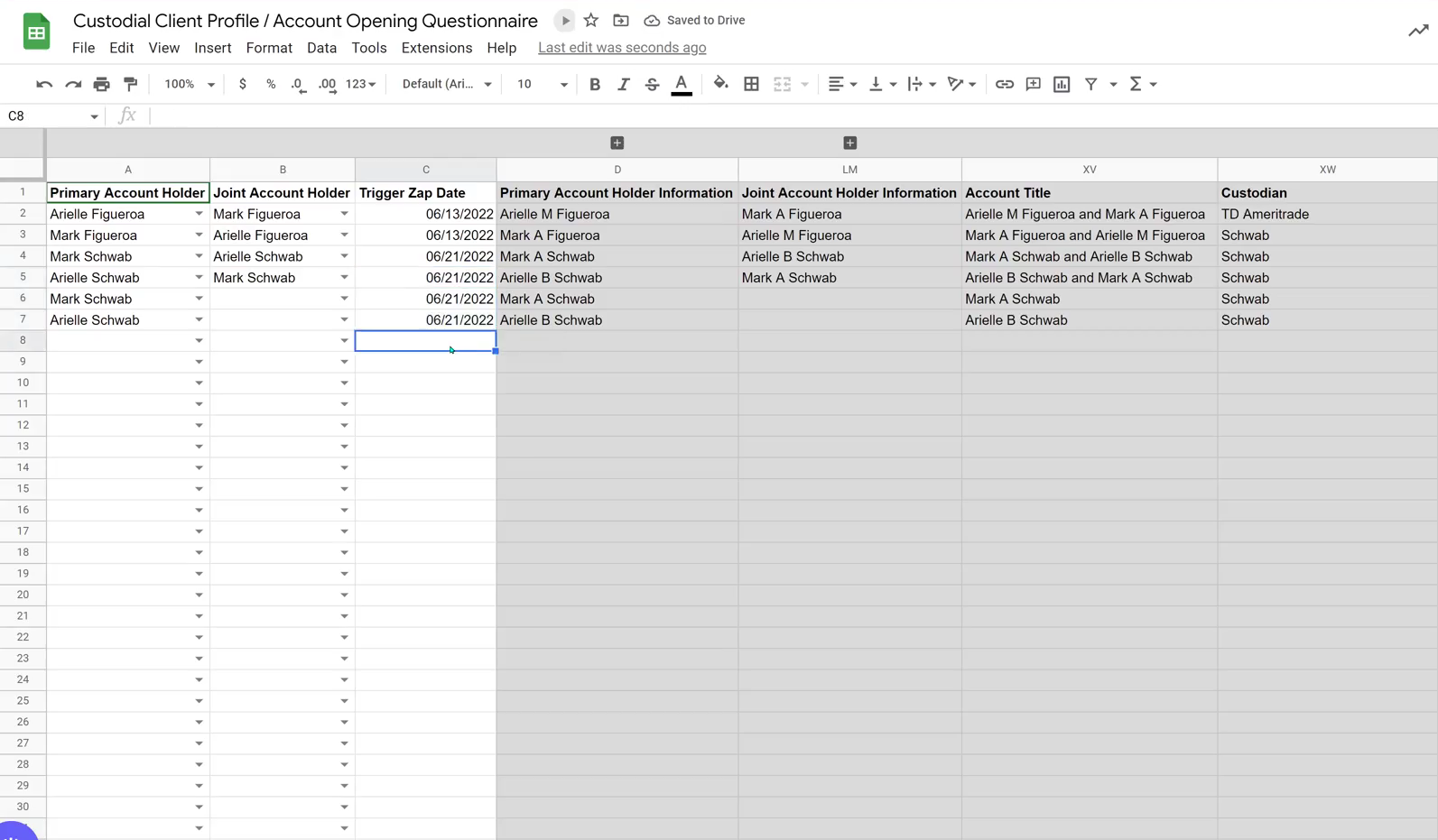

What you'll be doing in this sheet is essentially configuring the different arrangements in which your clients will fill out their prefilled paperwork. You'll only be working in the left three columns, but the darker gray columns to the right will prepopulate with information once the setup is complete. You can also click the "+" sign above each of the "Account Holder Information" columns to see each client's answers from the Client Profile Questionnaire.

You'll want to fill up to 4 blank rows with client names from the dropdowns provided, and the date as well. The amount of rows you fill will depend on how the Client Profile Questionnaire is answered. If it's an individual engagement, then you only need to fill one row, as there is only one client. However, if it's a joint engagement, you will need a row for the primary client, a row for the co-client, and at least one row for a joint account. If there are two separate joint accounts, one of which the primary account holder is the co-client, this is where you'll need to edit a fourth row, in order to get 4 separate packets of account paperwork. For each of the rows you add, be sure to include today's date in the "Trigger Zap Date" column, so the automation knows that it's time to run.

That part may have seemed a bit confusing, so here's a picture conveying the final result:

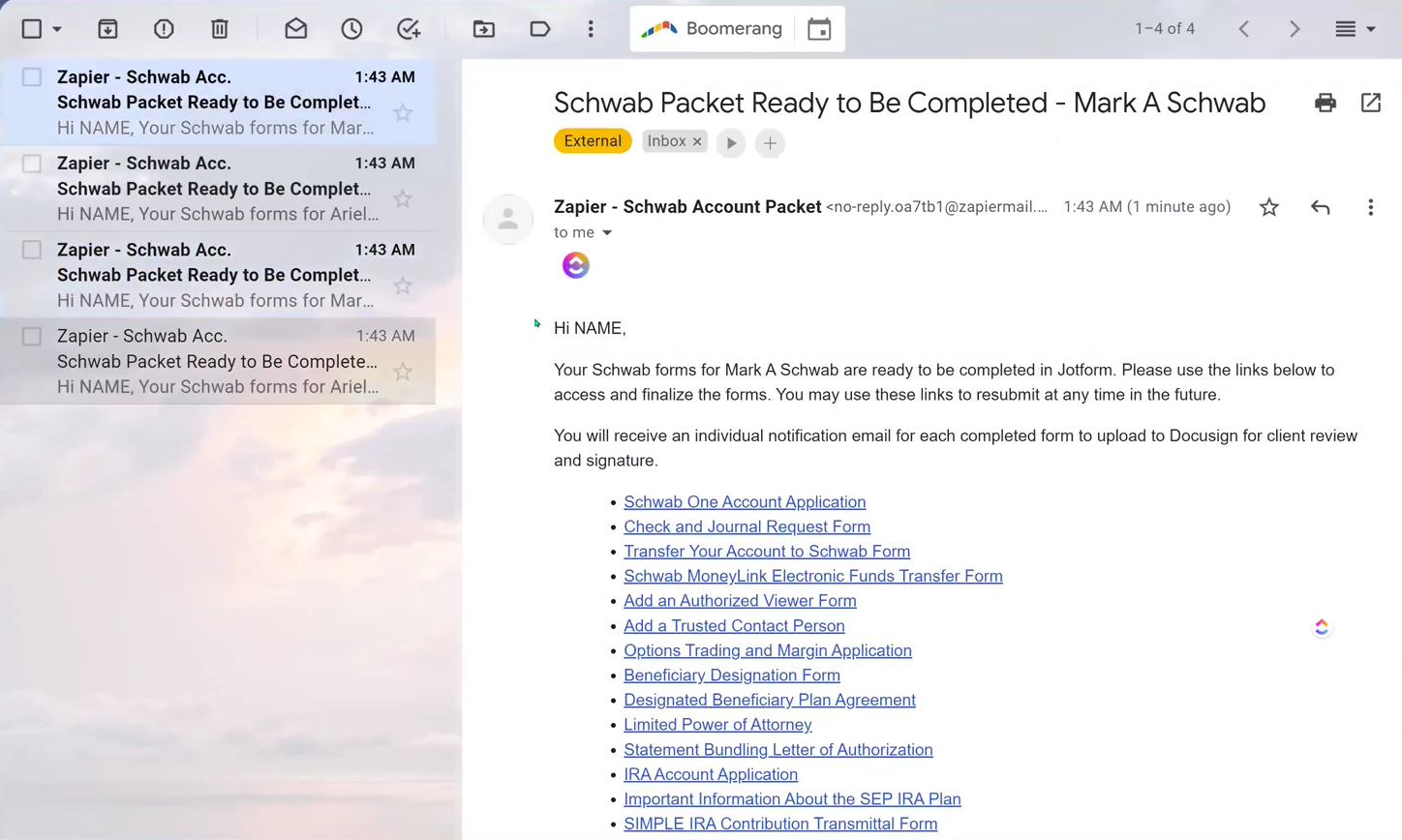

Once all of the necessary names and dates are filled in on the spreadsheet, you will receive an email - one for each row you filled in - containing links to the prefilled custodial forms for your clients to fill out.

Note: Zaps can take up to 15 minutes to run, so don't be alarmed if you don't receive an email right away. If you've waited 15+ minutes and still haven't received an email, or received an error message, please contact us at [email protected] to troubleshoot.

A couple things to note about this email:

- Where it says "NAME" will be addressed to either yourself, or the person responsible for filling out the forms.

- All of the forms shown will be prepopulated, but he only forms that you need to fill out are the ones that are applicable to the client.

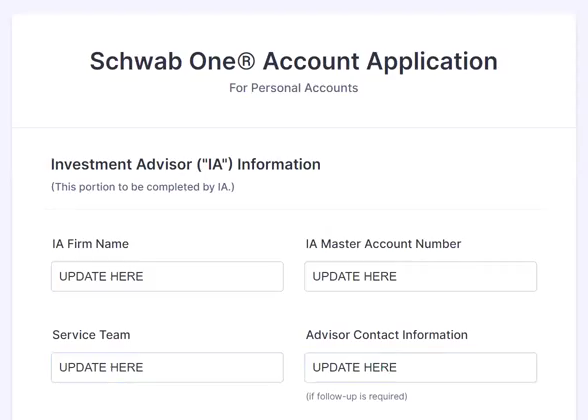

Filling Out The Individual Forms

The first thing that you'll see upon clicking one of the individual form links in the email is a section for investment advisor information. In this sample, it reads, "UPDATE HERE", but this will be filled with your name as part of the zap that creates these forms.

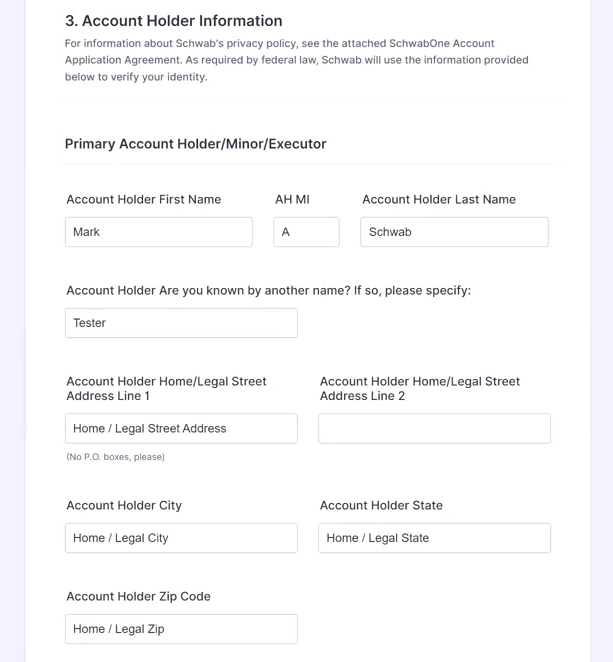

As you scroll further down, you'll notice that several fields are already prefilled with the information provided by the client in the Client Profile Questionnaire. This will remain true for any form that contains a question from the CPQ that was answered, and is a HUGE time-saver.

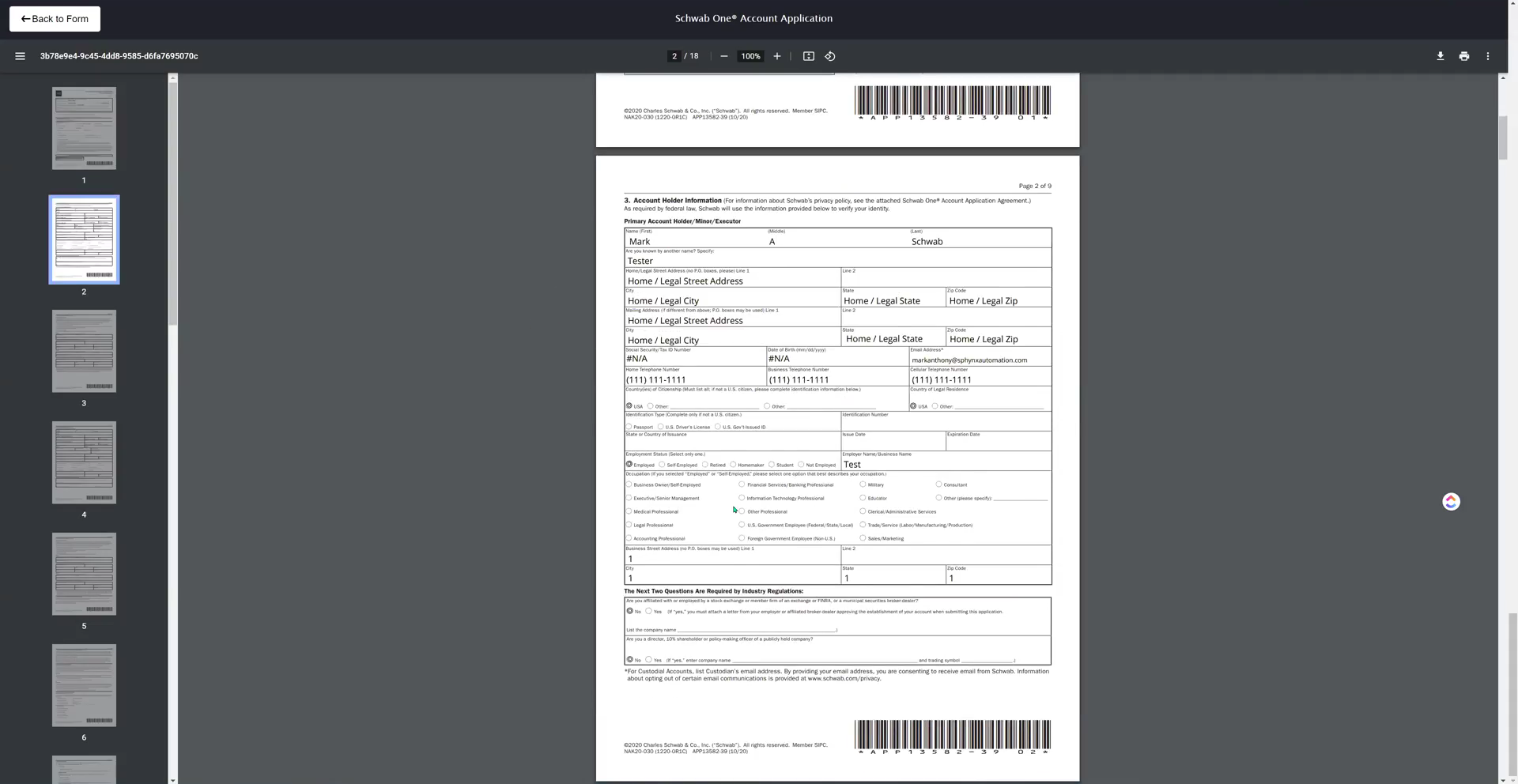

When you're finished with the form, you'll also see a "Preview PDF" button next to where you would select "Submit". You can use this function to ensure that you've entered everything that you needed to, as well as that all of your answers pulled through properly. In the picture below, not all of the fields were filled in, but it does show an example of what this PDF will look like upon it being filled from information provided on the form.

After you finally hit submit, you'll receive a confirmation email with a PDF copy of your answers.

Note: The large majority of these forms are rooted deeply in conditional logic, meaning there are plenty of fields that you either will or will not see based on your answers to other questions. If you see a blank field on the PDF but can't quite figure out where you missed a question, that's very likely because it didn't apply to the client and didn't show it to you when filling out the form.

Signatures

These forms will be signed outside of Jotform within DocuSign. To do this, simply download the PDFs of any forms you filled out, and create a DocuSign envelope to send to the client to sign. The creation of this envelope is not currently automated, but it remains something we'd like to look into doing in the future to further add efficiency to the process of filling out account paperwork.

Conclusion

With the amount of time that using our Automated Custodial Paperwork Packet will save, advisors can stop spending countless hours on monotonous paperwork filing, and instead shrink it down into a much more manageable timeframe that allows them to focus on other high priority areas of their firms. If what we've shown off here today interests you, be sure to schedule an intro call with us! If you'd like more information on the packet, feel free to watch this video walkthrough that our founder Arielle made to help our clients who are more visual learners, or email us at [email protected].

Stay tuned for our next blog post, releasing by the end of the month!

This blog is written by the Sphynx Automation team to help DIYers use web-based apps.

Not a DIYer? Not a problem, click the button below to chat with us.